When You Buy A House With A Mortgage

Most people really like shopping when they buy a house. In fact, the average home search in the US takes about four months. During the shopping period, you'll learn what is and is not important to you for a home in your price range, which neighborhoods you prefer, and what your deal-breakers are.

However, not nearly as many consumers enjoy the mortgage process as much as the house shopping. The majority surveyed by the Consumer Financial Protection Bureau (CFPB) only considered a single lender when financing their property. In addition, a significant percentage put off contacting a lender at all until after they had found a house to buy.

Fortunately, the vast majority of surveyed homebuyers were "very" satisfied with their mortgage lenders. This checklist is designed to help you enjoy the experience more and stress about it less.

Click to see today's rates (Apr 7th, 2017)

Start With A Lender

You really shouldn't begin shopping for a house until you know what you can spend. And if you want sellers and their agents to take you seriously, you need a pre-approval letter.

- You get one of those by applying to one or more mortgage lenders. Underwriters will likely have questions or lists of documents they want, and once you comply with their requests, you get your letter.

- The CFPB survey found that almost every borrower considered the interest rate or loan costs primary considerations when shopping for mortgage lenders. It's easy to request a fist full of quotes online, so get them now. Then, you can contact several of the most competitive lenders and evaluate them personally.

- Note the lenders whose style of working meshes with your own. If you prefer calls and get texts, or if your agent is hard-to-find when you have questions, choose someone who makes you more comfortable.

Next, you'll gather your documents.

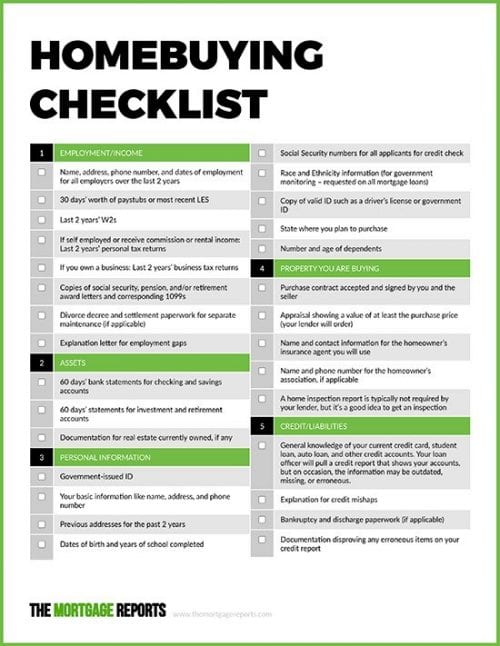

What Do Mortgage Lenders Want?

Mortgage lenders simply want to make sure that you can afford your loan and that you are likely to repay it as agreed. They must comply with government regulations requiring them to prove that they have evaluated you lawfully. That's what this list is about, period.

Employment/Income

- Pay stubs covering one month or most recent Leave and Earnings Statement from the military

- Last two years’ W2s

- If self-employed, a commissioned employee (25 percent or higher), an employee with unreimbursed business expenses or real estate income, you'll supply at least your last two tax returns. For income that is highly variable or unusual, you may need additional years.

- If you own a business, you need at least two years’ business tax returns.

- Proof of receipt for Social Security, pension, public assistance (if using to qualify) or other income. This usually means an award letter, check stub or direct deposit.

- Divorce decree and settlement paperwork for separate maintenance (if applicable)

- Explanation letter for employment gaps

Assets

- Two months’ bank statements for checking and savings accounts

- Two months’ statements for investment and retirement accounts

- Information for real estate already owned (use, income, if it's on the market, estimated value, mortgages)

Personal Information

- Government-issued ID

- Previous addresses for the past two years

- Dates of birth and years of school completed

- Social Security numbers for all applicants

- Race and Ethnicity information (for government monitoring – requested on all mortgage loans)

- State and county in which you plan to purchase

- Number and age of dependents

The Property

- Purchase contract accepted and signed by you and the seller (if you have one picked out)

- Name and contact information for the homeowner’s insurance agent you will use

- Name and phone number for the homeowner’s association, if applicable

Credit/Liabilities

- Your loan officer will pull a credit report that shows your accounts, but on occasion, the information may be outdated, missing, or erroneous. That information is incorporated into your application, and you're responsible for its review and confirmation.

- Explanation for credit mishaps

- Divorce decree and settlement paperwork for child or spousal support expenses (if applicable)

- Bankruptcy and discharge paperwork (if applicable)

- Documentation disproving any erroneous items on your credit report

Time For The Fun Part

Once you know exactly how much you can spend, and that you'll be able to buy any property that meets your lender's standards, the fun begins. Go shopping. And here's the fun part of the checklist, too.

This checklist below was originally created by HUD, and it does a good job of reminding you to pay attention to the same details for each house you see. As you complete the forms and see more houses, you and your agent should quickly learn what areas and home types are better fits.

Use one for each house you tour, and match it up with any pictures you take. Alternatively, there are several house-shopping apps that allow you to integrate your notes and pics into online files. For every criterion, note if the home feature is a good, average or poor fit for you.

The Home

- Square footage

- Number of bedrooms

- Number of baths

- Practicality of floor plan

- Interior walls condition

- Closet/storage space

- Basement

- Fireplace

- Cable TV

- Basement: dampness or odors

- Exterior appearance, condition

- Lawn/yard space

- Fence Patio or deck

- Garage

- Energy efficiency

- Screens, storm windows

- Roof: age and condition

- Gutters and downspouts

The Neighborhood

- Appearance/condition of nearby homes/businesses

- Traffic

- Noise level

- Safety

- Security

- Age mix of inhabitants

- Number of children

- Pet restrictions

- Parking

- Zoning regulations

- Neighborhood restrictions/ covenants

- Fire protection

- Police

- Snow removal

- Garbage service

Schools

- Age/condition

- Reputation

- Quality of teachers

- Achievement test scores

- Play areas

- Curriculum Class size

- Busing distance

Convenience

- Supermarket

- Schools

- Work

- Shopping

- Child care

- Hospitals

- Doctor/dentist

- Recreation/parks

- Restaurants/entertainment

- Church/synagogue

- Airport

- Highways

- Public transportation

So, your process is this: get mortgage quotes, choose a lender and loan, get pre-approved for your loan, then shop for your house, negotiate and close.

What Are Today's Mortgage Rates?

Remember that your first step for this checklist is to simply get your mortgage quotes and start the process. So order them up and start pulling your file together.

That way, once you have your pre-approval, it's easy to keep the file up-to-date. Just keep copy and toss in new pay stubs and bank statements in as they arrive.

Show Me Today's Rates (Apr 7th, 2017)

Courtesy of Dahna Chandler

The Mortgage Reports

Leave A Comment