Low Down Payment Home Loans For First-Time And Repeat Buyers

The biggest barrier to homeownership today is the mortgage down payment. But it doesn't have to be.

According to the National Association of Realtors, 87% of first-time buyers think they need 10% or more down to buy any of the homes for sale in Davenport, FL.

That’s simply false.

In fact, the average down payment for first time buyers today is just 6%. And, a number of programs require no down payment at all.

If you’re “stuck” trying to raise enough down payment money, you must read this entire article.

What Is A Down Payment?

A down payment is a portion of the purchase price that a buyer pays from his or her own funds. A 10% down home purchase is structured as follows.

- $100,000 purchase price

- $90,000 mortgage

- $10,000 down

But many loan programs allow you to use a very small down payment or none at all. The 20% down myth is just that: down payments are optional.

Should You Use A Low Down Payment Mortgage?

Your choice of loan depends on whether you want to make a down payment.

There are certainly benefits of making a down payment.

- You carry a lower loan balance

- You may avoid mortgage insurance

- You have more loan options from which to choose

But there are also drawbacks to making a down payment, especially a large one.

- It’s a greater risk to you

- You may not receive a better mortgage rate despite a large down payment

- You deplete your cash buffer for emergencies

Making a down payment depends on many factors including level of savings and even long-term plans.

Low And No Down Payment Loan Options

From zero down home loans to 10% down, there are many widely available loan options to choose from. All the loans mentioned are available from most lenders in the U.S. Explore all the no and low down payment mortgage options below.

FHA Home Loan

The FHA loan is one of the most popular options due to its lenient requirements.

Down payment required: 3.5%. However, 100% of the down payment can be a financial gift from a relative or approved non-profit.

Eligibility: U.S. citizens and permanent residents are eligible for an FHA loan. You do not have to be a first-time home buyer to qualify.

FHA mortgage insurance premium (MIP) and fees: 1.75% upfront and 0.85% of the loan balance per year, paid in 12 equal installments with the mortgage payment. On a $200,000 loan, that’s $3,500 upfront and $141 per month. The upfront fee can be rolled into the loan amount and does not need to be paid in cash.

FHA monthly mortgage insurance is non-cancellable without a refinance. This is one disadvantage of FHA compared to conventional loans, mortgage insurance for which can be removed when the home reaches 20% equity. To cancel FHA mortgage insurance, you must refinance into a conventional loan.

Credit: This is where FHA loans shine. You don’t need perfect credit or anywhere near to qualify. Some lenders approve FHA loans to borrowers with FICO scores down to 580. Some lenders may require a 620 score, though.

FHA mortgage rates: Thanks to solid government backing, lenders can offer FHA mortgage at rates much lower than for conventional loans. According to mortgage software firm Ellie Mae, FHA rates run about 0.15% lower than conventional ones.

Who is this loan good for? About 40% of home buyers under 37 use FHA, but plenty of older buyers choose it, too. This loan is best for those who don’t want to put a lot down, but still want great rates and flexible credit requirements.

VA Home Loan

The VA home loan is a zero down mortgage option for home buyers with current or former military service. It’s often the top choice for for those eligible because it offers 100% financing and does not require great credit.

Zero down payment mortgage: 0%. VA loans require no down payment, but those who wish to can make put any amount down.

Eligibility:Eligibility is based on current or former military service. Required service requirement is typically 90 days if currently serving, or two years on active duty if separated from service.

Those in the Reserves or National Guard are eligible after six years of service.

VA mortgage insurance and fees: Typically, 2.15% upfront fee is required for first-time home buyers putting less than 5% down. If you’ve used a VA loan before, your upfront fee increases to 3.3% of the loan amount. Veterans receiving benefits for injuries sustained on duty are exempt from the funding fee.

VA loans do not require monthly mortgage insurance – a potential savings of hundreds of dollars per month. This allows home buyers to afford a more valuable home.

Credit: Required FICO scores are usually 620 and above, although some lenders will allow lower credit scores. VA does not officially publish a minimum score for the program.

VA mortgage rates: VA mortgages come with some of the lowest ratesavailable anywhere. Rates run almost one-half of a percentage point below conventional rates according to Ellie Mae.

Who is this loan good for? The VA loan option should be the first loan type that military veterans consider. With no monthly mortgage insurance, lenient credit requirements, and low rates, eligible home buyers are often surprised they can buy a home – and with zero down, too.

Table Of Lending Low Down Payment Options

| Minimum Downpayment | Minimum Credit Score | Upfront Fees | Mortgage Insurance | What you need to know | |

|---|---|---|---|---|---|

| VA Home Purchase | 0% | Officially, none, but lenders are allowed to set their own minimums | 0% | None | Only service members, veterans and surviving spouses are eligible. |

| FHA Home Purchase | 3.5% for applicants with credit score of 500/579 | Officially, 500 for a 90% loan and 580 for a 96.5% loan. Lenders often set higher minimums. | 1.75% upfront mortgage insurance premium (MIP) which can be wrapped into the loan. | .85% of the existing loan balance per year for most buyers, but ranging from 45 to 1.05% | FHA is not restricted to first-timers or low-income buyers. |

| USDA Home Purchase | 0% | Typically, lenders require a 640 score | 1.00% upfront mortgage insurance (MIP), which can be wrapped into the loan. | .35% of the existing loan balance per year, paid monthly | USDA is not restricted to first-timers or low-income buyers |

| Home Ready/Home Possible Purchase | 3% | 620 if manually underwritten, none if underwritten electronically and approved | 3% | 3% | Offered by Fannie Mae and Freddie Mac to borrowers who meet specific income criteria or buy properties in |

| Other Conforming Home Purchase | 3% for first-time buyers, 5% for highly-qualified repeat buyers | 680%+ for LTV > 75%, 620 for LTV > 75% | 3% for first-time buyers, 5% for highly qualified repeat buyers | 3% for first-time buyers, 5% for highly-qualified repeat buyers | 5% for highly-qualified buyers |

| Non-conforming (Jumbo) Home Purchase | 5% for highly-qualified buyers | Not standard, but generally 680+ | 5% for highly-qualified buyers | 5% for highly-qualified buyers | Underwriting is strict for large loans. These are not standard and must meet requirements of investor or... |

USDA Home Loan

Also known as the Rural Development (RD) or Rural Housing loan, the USDA loan offers 100% financing, a good 0 down mortgage option to those buying in non-urban areas.

No Money Down Mortgage : 0% down home loan.

Eligibility: Home buyers purchasing in suburban and rural areas should check their area’s USDA eligibility. About 97% of U.S. land mass is eligible, and suburban neighborhoods across the U.S.

Also, the home buyer must make 115% or less of their area’s median income. Check local income limits here. For instance, a home buyer in an area with a $70,000-per-year median income can make up to $80,500 annually.

Mortgage insurance and fees: 1.0% of the loan amount upfront, and 0.35% per year based on the current loan balance. For example, a $200,000 loan would require a $2,000 upfront fee (rolled into the loan) and $58 per month.

Credit: Credit score minimums are low for a USDA loan. You can receive a streamlined approval with a score above 640. For applicants with lower scores, there may be additional paperwork requirements, but your application will still be considered.

USDA mortgage rates: USDA rates are some of the lowest on the market. The United States Department of Agriculture (USDA) backs these loans, so lenders can offer them at low rates. USDA’s mandate is to promote affordable homeownership in less densely populated areas, and accomplishes that by offering low-cost mortgages.

Who is this loan good for? Anyone looking outside of a downtown core or major metro should consider a USDA loan. With no money down, low rates, and lower fees than FHA, the affordability of USDA is almost unmatched in the mortgage market.

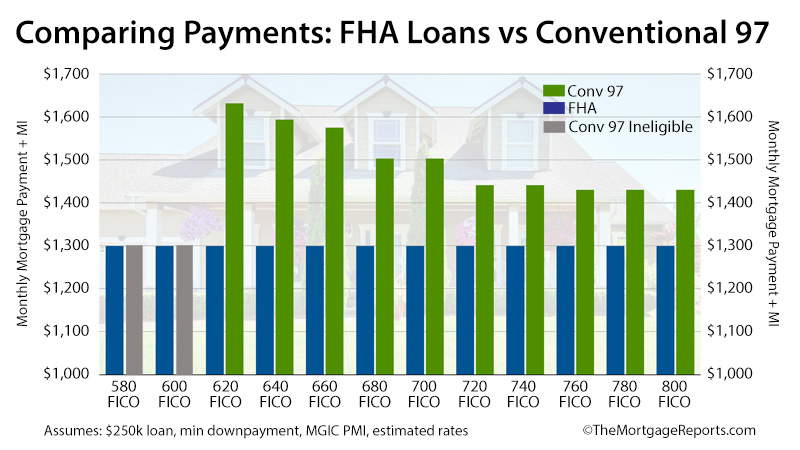

Conventional 97

The Conventional 97 is a 3% down option offered by Fannie Mae. Compared to other 3% conventional options, this loan has fewer eligibility restrictions.

Down payment required: 3%. The entire down payment can come from a financial gift from a relative or other approved source.

Eligibility: First-time and repeat buyers are eligible. There are no income limits, and home buyer education courses are not required.

Mortgage insurance and fees:Conventional loans do not come with an upfront fee as do FHA, VA and USDA loans. However, monthly private mortgage insurance (PMI) is necessary for any down payment lower than 20% on a conventional loan.

Mortgage insurance is based on credit score and typically ranges between 0.75% to 1.5% of the loan amount per year.

For those with credit scores below 720, FHA might be the cheaper monthly option. FHA does not raise mortgage insurance rates for lower credit scores.

Conventional PMI, though, is cancelable when your home reaches 20% equity. FHA mortgage insurance requires a refinance into a conventional loan to cancel its mortgage insurance.

Credit: You need fairly good credit scores for this program. Otherwise, mortgage insurance fees are quite high.

Conventional 97 mortgage rates: Mortgage rates are good for conventional loans. A small premium is collected for the 3% down option which may increase your rate slightly.

Who is this loan good for? Applicants with good credit, 3% down, and extra cash for closing costs can choose a Conventional 97 loan. Still, FHA may be the more cost-effective choice. See our comparison between low down payment conventional and FHA mortgages.

Click here to verify your eligibility for a Conventional 97 loan.

The HomeReady™ Mortgage

This loan is a 3% down conventional option from Fannie Mae that offers more flexibility than the standard Conventional 97.

Down payment required: 3%. All the down payment and closing costs can come from a down payment gift.

Eligibility: HomeReady™ comes with income limits. Your income must be equal to or less than your area’s median income. No limits apply in some low-income areas. Homeownership education is required and can be completed online.

Mortgage insurance and fees: Eligible applicants qualify for lower PMI costs compared to the standard Conventional 97 loan. PMI is around $30 per month cheaper with a 720 score and the typical loan amount.

Credit: The stated credit score minimum is 620, but lenders will likely require a higher score to qualify.

HomeReady™ mortgage rates: Applicants with credit scores above 680 qualify for better mortgage rates compared to the Conventional 97.

Who is this loan good for? This program offers a myriad of special features.

- Use roommate and boarder income to qualify

- Income from non-borrowing household members can help you get approved

- Gifts and grants can be used for the down payment and closing costs

- Rental income from a basement or mother-in-law unit is eligible

This program works well for home buyers with moderate income, needing extra help from live-in family to afford a mortgage.

Piggyback Loans

A piggyback loan is one in which a first and second mortgage are opened simultaneously to cover a larger part of the home’s purchase price.

These are also known as 80/10/10s or 80/15/5s. The first number represents the first mortgage amount, the second number is the second mortgage, and the third number is the down payment.

- $200,000 home price

- $160,000 first mortgage (80%)

- $20,000 second mortgage (10%)

- $20,000 down (10%)

A piggyback loan is typically used to avoid private mortgage insurance.

Down payment required: 5-10% depending on the primary and secondary mortgage amounts.

Eligibility: No restrictions on first-time home buyer status, geographic location, or income.

Mortgage insurance and fees: A piggyback loan eliminates upfront and monthly mortgage insurance fees. Lenders do not require PMI because the primary mortgage is at or below 80% of the purchase price.

You will have a second mortgage, which will come with a monthly payment and perhaps additional closing costs. You can pay off that loan anytime and leave your first mortgage intact.

Credit: You usually need solid credit scores to qualify for a piggyback loan – most likely above 680. You qualify for both the first and second mortgages separately, and the second mortgage typically has more stringent credit requirements of the two.

Piggyback mortgage rates: Rates are good for piggyback loans because you are getting a conventional “standard” loan for the primary financing. The second mortgage could be from an entirely different source, though. Shop around for a lender that can handle both loans simultaneously and offers good rates on your secondary financing.

Who is this loan good for? Buyers who are PMI-averse should look into 80/10/10 piggyback loans. You pay no mortgage insurance and you can pay off the second mortgage at any time without a refinance. You are left with one primary mortgage with a low rate.

Home Possible Advantage®

Down payment required: 3%

Eligibility: There is no first-time home buyer requirement for this loan, however, you can’t own any other property in most cases. Like HomeReady™, you can earn up to 100% of your area’s median income.

Mortgage insurance and fees: This loan requires lower mortgage insurance fees as compared to the Conventional 97 loan. On a $200,000 loan, an applicant with a 720 FICO score saves about $30 per month on mortgage insurance.

Credit: This loan is best for those with a fair to excellent credit score.

Home Possible Advantage® mortgage rates: Mortgage rates are only slightly higher compared to standard conventional loans.

Who is this loan good for? This loan is best for moderate income earners who seek a small down payment and cancelable mortgage insurance. Typically, credit score requirements will be higher than those of FHA. And, initial mortgage insurance fees may be higher than FHA, too. Compare this loan with HomeReady™ and FHA when you apply.

HomePath Ready Buyer

This is a closing cost assistance program with which you can receive up to 3% of your loan amount toward your closing costs. This is available to those purchasing HomePath homes, which are Fannie Mae foreclosure properties.

A specialized homeownership course is required.

Down payment: 3% minimum

Eligibility: You must purchase a HomePath property.

Loan Options: You can use Fannie Mae’s low down payment loan, HomeReady™, or any other type of financing.

About Using Gift Funds

Cash gifts can be used for a down payment on a home. Typically, gifts must come from a family member or approved non-profit or down payment assistance program. Interested parties such as the real estate agent, seller, or mortgage broker may not contribute gift funds.

Additionally, when you're receiving a cash gift, you'll want to make sure you follow a few procedures.

For example, make sure the gift is made using a personal check, a cashier's check, or a wire; and keep paper records of the gift, including photocopies of the checks and of your deposit to the bank. Also, make sure that your deposit matches the amount of the gift exactly.

Your lender will also want to verify that the gift is actually a gift and not a loan-in-disguise. Cash gifts do not require repayment.

Down Payment Assistance & Grants

Down Payment Assistance (DPA) programs and non-repayable grants can be used to pay for all or part of your down payment. Programs vary widely by region. A full 87% of homes are eligible for some kind of assistance, but few home buyers apply. Check local city, county, and state websites, plus regional and national sources for potential DPA programs.

Sources Of Down Payment

A down payment can be funded multiple ways, and your lender will often be flexible. Some of the more common ways to fund a down payment is to use your savings or checking account; or, for repeat buyers, the proceeds from the sale of your existing home.

However, there are other ways to fund a down payment, too. For example, home buyers can receive a cash gift for their down payment or can borrow from their 401k or IRA (although that's not always wise).

Regardless of from where you fund your down payment, though, make sure to keep a paper trail. Without a clear account of the source of your funds, a mortgage lender may not allow its use.

Comparing Loan Types

Consider all your options when applying for any mortgage. Each type comes with its own advantages. Peruse the above list of loans. If your lender is not offering one of them, ask why. It could be that you are not eligible, or it could be that the lender doesn’t offer the program or doesn’t know about it. Find a new lender if you’re not getting your questions answered satisfactorily.

Low Down Payment Mortgage Lenders

Just about every lender in the country offers low down payment loans. These are national programs, not regional ones. Most banks, mortgage companies, credit unions, and mortgage brokers offer similar programs.

Shop around for the best rates, though. Lenders’ rates can vary by one-half of a percentage point or more, which is equal to $83 per month on a $200,000 mortgage. There is no shortage of lenders that will compete for your business.

Affordability

The answer to the question of "How much home can I afford?" is a personal one, and one which should not be left to your mortgage lender.

The best way to answer the question of how much can you afford for a home is to start with your monthly budget and determine what you can comfortably pay for a home each month. Then, using your desired payment as the starting point, use a mortgage calculator to work backwards in order to find your maximum home purchase price.

Note that today's mortgage rates will affect your mortgage calculations so be sure to use current mortgage rates when you're doing your calculations. When mortgage rates change, so does home affordability.

How Do I Check My Low Down Payment Eligibility?

You might be surprised at what you can qualify for, even if you have no money down. Get an eligibility check today. Even if you’ve been turned down before, lenders are loosening guidelines and you might be approved.

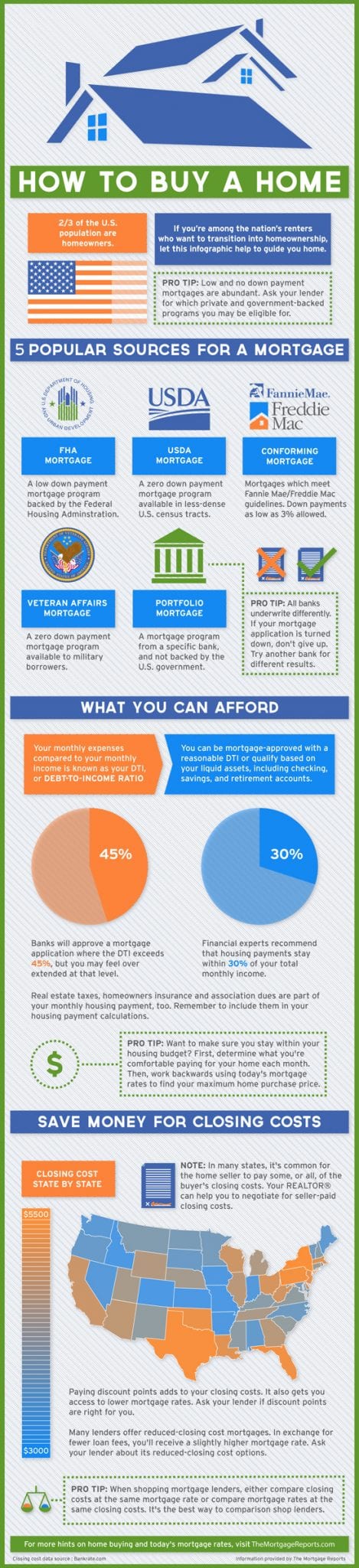

Infographic: How To Buy A Home

Leave A Comment