Mortgage Interest Deduction: How Your House Pays You Back

Buying a home delivers emotional satisfaction as well as a proven method of wealth-building. The mortgage interest deduction is another appealing benefit for prospective buyers.

Real estate agents and home builders tout this tax deduction as an incentive to buy a home. They like to claim that it increases the homeownership rate and helps people transform from renters to homeowners.

The mortgage interest tax deduction was introduced in 1913. It has survived numerous tax reforms because of the incentive the tax provides for renters to buy homes.

Housing industry advocates have consistently lobbied to protect the deduction because it helps make buying a home easier. That increases the pool of potential purchasers. (And potential income to the industry.)

Click to see today's rates (Apr 7th, 2017)

Mortgage Interest Deduction Details

The amount of interest you can deduct depends on the type of mortgage you have.

You can deduct the interest you pay each year on mortgages you use to buy, build or improve your home up to a maximum combined mortgage debt of $1 million. (Or $500,000 if you are married and filing your taxes separately.)

This includes home equity debt as long as the funds were used to pay for home improvements or to purchase or build your home.

If you have home equity loans or lines of credit that you used for purposes other than acquiring or improving your home, you can deduct only the interest on balances up to $100,000. (Or $50,000 or less if you’re married and filing your taxes separately.)

An Example Of The Mortgage Interest Tax Deduction Calculation

Suppose, for example, that your home is currently valued at $400,000. You have the following mortgages:

- a $250,000 first mortgage used to buy your house several years ago.

- a home equity loan of $110,000 that you used to pay college tuition (not acquire or build the house)

Unless you’re married and filing a separate return, you can deduct most of the mortgage interest you paid -- all the debt used to acquire the home and interest paid on $100,000 of the $110,000 home equity loan used for college.

You can only take the mortgage tax deduction if you itemize your taxes, and that's only worth doing if the total on your Schedule A exceeds your standard deduction. For 2016 tax returns, the standard deduction is $6,300 for singles and $12,600 for couples.

Who Benefits Most From The Mortgage Interest Tax Deduction?

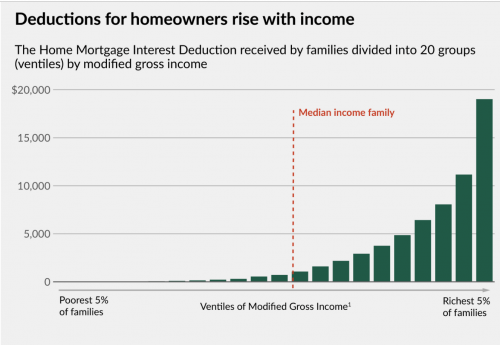

A recent study by the Tax Policy Center found that about 40 million (22.5 percent) of households in the U.S. actually benefit from the mortgage interest deduction. This is because many lower to- middle-income homeowners don’t itemize their tax deductions.

When comparing the impact of the mortgage interest tax deduction on homeowners, the tax savings are naturally much higher for higher-income taxpayers who have larger mortgages than for middle-class taxpayers with smaller mortgage balances, simply because they have more interest to deduct and are in a higher tax bracket.

However, experts at think tanks such as the Washington Center for Equitable Growth, claim that, "these programs appear to do little to achieve the goal of expanding homeownership. In fact, research finds that mortgage innovation, not tax policies, have had the largest effect in increasing homeownership over the past decade."

Politics And The Mortgage Interest Tax Deduction

The mortgage interest tax deduction is highly popular, and that popularity has saved it many times.

However, the recent focus on tax reform by the Republican-led Congress and the Trump administration means the deduction could be in trouble, if Congress is willing to risk the ire of constituents and lobbyists.

Tax reform comments so far have focused on reducing tax rates and increasing the size of the standard deduction. This could cause more homeowners to take the standard deduction and not itemize. Those with deductions exceeding the standard (the chief recipients of the benefits of the current deduction system), still get to deduct their interest.

Higher Standards?

According to Time Magazine, President Trump would like to raise the standard deduction to $30,000 for couples who file taxes jointly filers, up from $12,600 in 2016. The House tax plan would increase the standard deductions for couples to $24,000.

Treasury Secretary Steve Mnuchin said before he was confirmed that the mortgage interest deduction could be capped but not eliminated. He wants to renegotiate a full range of tax reform proposals at that time.

The mortgage interest tax deduction is estimated to reduce tax revenue for the federal government by $75 billion annually. However, the impact of capping or eliminating the mortgage interest deduction could reduce demand for homes and could hurt home values.

Concern about that impact could mean that the deduction goes untouched again. In the meantime, homeowners can be thankful as they file their income taxes this year.

What Are Today's Mortgage Rates?

Current mortgage rates depend on many factors, including the money supply. Anything that increases the money supply, such as reduced taxes, tends to push up interest rates. However, that's just one of many conditions that drive interest rates. Another consideration that determines what you pay is the number of rate quotes you get from competing lenders.

That's something we can help you with.

Show Me Today's Rates (Apr 7th, 2017)

Courtesy of Michele Lerner

The Mortgage Reports

Leave A Comment