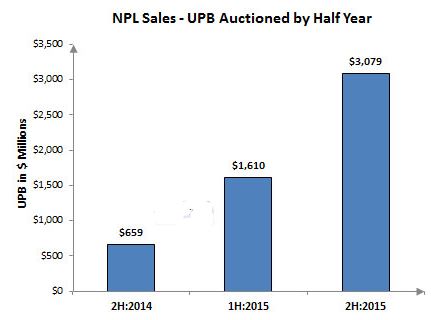

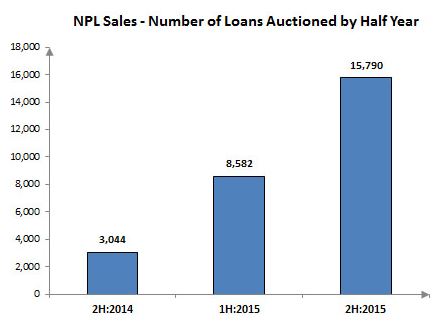

As Fannie Mae did earlier in January, Freddie Mac kicked off 2016 in a big way with residential non-performing loan (NPL) sales. On Friday, Freddie Mac announced its largest bulk NPL transaction yet—an auction of residential NPLs serviced by Nationstar Mortgage totaling $1.6 billion in unpaid principal balance (UPB).

As Fannie Mae did earlier in January, Freddie Mac kicked off 2016 in a big way with residential non-performing loan (NPL) sales. On Friday, Freddie Mac announced its largest bulk NPL transaction yet—an auction of residential NPLs serviced by Nationstar Mortgage totaling $1.6 billion in unpaid principal balance (UPB).

The NPLs are being offered in seven pools—five Standard Pool Offerings (SPOs), which are geographically diversified, and two Extended Timeline Pool Offerings (EXPOs), which are geographically concentrated. EXPOs. While SPOs often include larger pools of loans, the loans featured in EXPOs include smaller pool sizes and a longer marketing period, and target participation from smaller investors, including non-profits and minority- and women-owned businesses (MWOBs). Bids are due on February 23 for the SPOs and March 8 for the EXPOs, and the sales are expected to settle in the second quarter of 2016.

Freddie Mac’s last bulk NPL sale was completed in December when about 5,300 deeply delinquent loans serviced by Wells Fargo with an aggregate UPB of $1.1 billion were sold via auction in five SPOs. Pretium Mortgage was the winning bidder in three of the pools and 21st Mortgage Corporation and Rushmore Loan Management were the winners of the other two pools.

Both GSEs have made a substantial push in the last year to follow the directive of their conservator, the Federal Housing Finance Agency, to excise NPLs and deeply delinquent loans from their residential mortgage portfolios. On January 12, Fannie Mae announced its first bulk NPL sale of 2016 and fourth overall. Like the Freddie Mac NPL auction announced on Friday, Fannie Mae’s first NPL sale of 2016 will be its biggest yet in terms of UPB, featuring 6,700 deeply delinquent loans in five pools totaling $1.35 billion in UPB. That sale includes four larger pools and a smaller Community Impact Pool targeting smaller investors, similar to Freddie Mac’s EXPOs.

Both GSEs have made a substantial push in the last year to follow the directive of their conservator, the Federal Housing Finance Agency, to excise NPLs and deeply delinquent loans from their residential mortgage portfolios. On January 12, Fannie Mae announced its first bulk NPL sale of 2016 and fourth overall. Like the Freddie Mac NPL auction announced on Friday, Fannie Mae’s first NPL sale of 2016 will be its biggest yet in terms of UPB, featuring 6,700 deeply delinquent loans in five pools totaling $1.35 billion in UPB. That sale includes four larger pools and a smaller Community Impact Pool targeting smaller investors, similar to Freddie Mac’s EXPOs.

The transaction announced on Friday is Freddie Mac’s third bulk NPL sale worth more than $1 billion. The previous two were worth $1.1 billion each. Overall, it will be Freddie Mac’s ninth bulk Standard Pool Offering (SPO) auction since the first sale closed in August 2014 and the two EXPOs will be the second and third sold. Freddie Mac’s first-ever EXPO sold in June via auction to Corona Asset Management, and included 157 deeply delinquent loans with an aggregate UPB of about $31 million.

All bidders must comply with the Federal Housing Finance Agency (FHFA)'s enhanced requirements for NPL sales announced on March 2, which include approval by and good standing with government housing agencies (Freddie Mac, Fannie Mae, Ginnie Mae, and the Federal Housing Administration); evaluating borrowers for eligibility in the government's Home Affordable Modification Program (HAMP); and applying a "waterfall" of resolution tactics before resorting to foreclosure.

All bidders must comply with the Federal Housing Finance Agency (FHFA)'s enhanced requirements for NPL sales announced on March 2, which include approval by and good standing with government housing agencies (Freddie Mac, Fannie Mae, Ginnie Mae, and the Federal Housing Administration); evaluating borrowers for eligibility in the government's Home Affordable Modification Program (HAMP); and applying a "waterfall" of resolution tactics before resorting to foreclosure.

For more information about Freddie Mac's NPL sales, click here.

Courtesy of: Brian Honea

DS NEWS

Leave A Comment