Not Everyone Understands The VA Mortgage

The VA mortgage is arguably the best mortgage available. However, many home sellers, real estate agents and consumers make some incorrect assumptions about the program, and that can affect your ability to use the product.

If you are eligible to use this home loan, don't let someone else's ignorance cost you money by keeping you from applying for a VA mortgage.

Check Out Our Downloadable Ultimate Guide to VA Benefits And Eligibility

If you encounter a home seller, listing agent, or anyone else who wants to dissuade you from using a VA home loan, set them straight with this article.

Click to see your VA loan eligibility (Jul 5th, 2017)

Myth # 1: The Government Requires The Seller To Pay Your Loan Fees

That's not true. Rules about fees were only created to prevent service providers from overcharging veterans. For instance, a VA buyer cannot be charged a commission by the real estate agent for finding property. But real estate commissions are traditionally paid by the seller anyway.

4 Ways To Keep Your Mortgage Closing Costs Low

Here are other fees the law says VA homebuyers cannot pay under existing law:

- Lender miscellaneous charges (aka "junk fees") when the borrower is already paying an origination fee. The origination charge cannot exceed one percent of the loan balance unless the mortgage is a construction loan.

- HUD or FHA inspection fees that home builders normally pay.

- Prepayment penalties for the seller's existing mortgage.

- Attorneys fees charged by the lender -- however, you can pay reasonable, customary costs for title work, which may include attorney services.

For nearly every transaction, home sellers don't pay any more for a VA borrower than they would a conventional mortgage borrower.

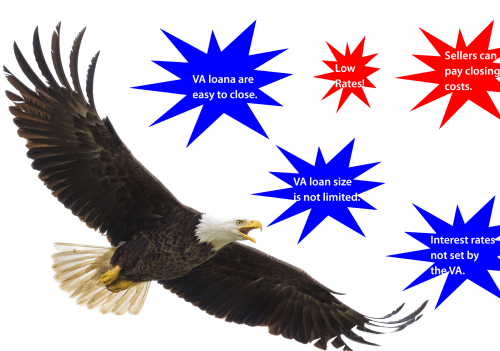

Myth #2: Sellers Can Pay Your Closing Costs, Up To 4% Of Your Sales Price

This is kind of true, but they can actually pay more than four percent. "Seller concessions" are limited to four percent of the property value, but that is not all they can pay.

The VA says, "Seller concessions do not include payment of the buyer’s closing costs, or payment of points as appropriate to the market."

The seller, lender, or any other party may pay fees and charges, including discount points, on behalf of the borrower.

Get Sellers To Pay Your VA Closing Costs

A motivated seller can pay your normal closing costs, plus additional charges of up to four percent of the property value for items like these:

- Buyer’s VA funding fee

- Buyer’s property taxes and insurance

- Extras like a snow blower or flat screen TV

- Extra discount points to lower the buyer's interest rate

- Pay off credit card balances to help buyers qualify for their mortgage

For example, if the market interest rate is 4.25 percent with one origination and one discount point, your seller can pay that and your other closing costs. That does not count toward the seller concession limit.

Suppose your debt-to-income ratio is too high because of credit card balances that total three percent of the property value. You want the house, but can't qualify for the VA mortgage.

The seller could choose to pay those balances off for you to help you qualify for the loan, and pay an additional discount point to reduce your mortgage rate and make the home more affordable.

Of course, if the seller is getting a higher price for the house to offset these concessions, the property will have to appraise for at least the sales price to make the deal fly.

Myth #3: VA Mortgages Take A Long Time To Close

Another concern for sellers is that VA mortgages take a long time to close. That is also not true.

According to mortgage industry analysts at Ellie Mae, the average VA mortgage closes in 45 days, while the average closing time for all loans is 42 days. The difference is a mere three days.

How To Rush Your Mortgage To The Closing Table

You, as a buyer, can relieve the seller's concerns by getting pre-approved for your VA mortgage so you can close much faster. That means submitting an application, authorizing a credit report, and documenting your income and assets.

Mortgage pre-approval, also called credit approval, means that you are good to go and can close as long as the property meets the lender's guidelines. If all you need is an appraisal to close, you can probably get that in ten days or fewer.

Myth #4: The Government Sets VA Interest Rates And Closing Costs

You or your home seller may think that it doesn't matter which VA lender you use -- that the federal government sets VA mortgage rates.

Your agent or the seller's agent may even push you to use their "preferred" lender, and you might think that all lenders are the same and charge the same rate.

Should You Use Your Real Estate Agent's Preferred Lender?

The fact is that the government does not lend money for VA home loans. It simply insures them, which protects the lender if you default.

Private sector lenders make VA mortgages and set their own interest rates and loan charges. It is up to you to shop and compare offers from competing lenders.

You can certainly get an interest rate quote from a preferred lender, but compare that with quotes from additional lenders to get your best deal.

Myth #5: VA Home Loans Are A Hassle

In fact, VA mortgages make it easier to qualify, and that most of the process is automated and speedy. For instance, your lender can probably obtain your Certificate of Eligibility (COE) electronically, and underwrite your mortgage the same way.

How To Get Your Certificate Of Eligibility

The only real difference is that you need a VA appraisal from a VA-approved appraiser, and that may cost a little more and take a little longer.

In addition to the property value, the VA appraisal must show that the home is safe and livable. The VA maintains a list of MPRs the property must meet to be eligible for financing.

Myth #6: VA Loan Sizes Are Limited

That's only sort of true. While 100 percent VA home loans are limited, if you're willing to make a down payment, you can borrow as much as a lender is willing to lend.

What Are The Current VA Mortgage Loan Limits?

You just have to put down 25 percent of the excess purchase price. For instance, if the VA loan limit in your area is $500,000, and you want to buy a $600,000 house, you'd put down 25 percent of the amount over $500,000.

In this case, the excess is $100,000, so you'd make a down payment of $25,000. That means you put down 4.2 percent of the purchase price and pay no mortgage insurance -- a great deal by anyone's standards.

Courtesy of Gina Pogol

The Mortgage Reports

Experience You Can Count On!

If you are Buying or Selling a Home in Davenport, Champions Gate, Clermont, Haines City, Kissimmee/Celebration/Reunion, Windermere, Winter Garden, Winter Haven to Orlando you will find our website an Outstanding Resource.

For a FREE, no cost Market valuation for your house or NO OBLIGATION buyer consultation, contact us today!

Posted by Florida Realty Marketplace on

Leave A Comment